Crypto Market Size: A Comprehensive Analysis

In recent years, cryptocurrencies have gained significant attention as a decentralized form of digital currency. As the popularity of cryptocurrencies continues to grow, understanding the crypto market size becomes essential. This article aims to provide a comprehensive analysis of the crypto market, exploring its current size, growth trends, factors influencing its expansion, and future prospects.

Understanding Crypto Market Size

The crypto market size refers to the total valuation of all cryptocurrencies available in the market. It encompasses various aspects such as market capitalization, trading volume, and the number of active users. The crypto market has experienced remarkable growth since its inception, attracting both individual investors and institutional players.

Factors Influencing Crypto Market Growth

a) Technological Advancements: The development of blockchain technology has been a driving force behind the growth of the crypto market. Blockchain ensures transparency, security, and immutability, making it an ideal platform for digital currencies.

b) Investor Sentiment: Investor sentiment plays a crucial role in the crypto market. Positive news, such as institutional adoption or regulatory support, can lead to a surge in demand and subsequently increase the market size.

c) Market Speculation: The speculative nature of the crypto market often leads to price volatility. Traders and investors actively participate in buying and selling cryptocurrencies, which can influence the market size.

The Role of Market Capitalization

Market capitalization is a key metric used to measure the size of the crypto market. It represents the total value of a cryptocurrency by multiplying its price by the circulating supply. Bitcoin, being the largest cryptocurrency, often dominates the market capitalization of the overall crypto market.

Key Cryptocurrencies in the Market

a) Bitcoin (BTC): As the first and most well-known cryptocurrency, Bitcoin holds a significant share of the crypto market. Its market size has a considerable impact on the overall crypto market.

b) Ethereum (ETH): Ethereum is a blockchain platform that enables developers to build decentralized applications and smart contracts. Its market size has been steadily growing due to its utility and widespread adoption.

c) Ripple (XRP): Ripple offers a real-time gross settlement system that facilitates fast and low-cost international money transfers. Despite its market size being lower than Bitcoin and Ethereum, Ripple has gained traction in cross-border transactions.

Economic and Technological Factors

The crypto market size is influenced by various economic and technological factors. These include:

a) Inflation: Cryptocurrencies can serve as a hedge against inflation, leading to increased adoption during times of economic uncertainty.

b) Technological Innovations: Advancements in blockchain technology, scalability solutions, and decentralized finance (DeFi) contribute to the growth of the crypto market.

c) Global Financial Crisis: Historical events, such as the 2008 financial crisis, have highlighted the need for alternative financial systems, leading to increased interest in cryptocurrencies.

Government Regulations

Government regulations play a pivotal role in shaping the crypto market size. Regulatory frameworks and policies can either foster or hinder the growth of cryptocurrencies. Clarity and supportive regulations often attract institutional investors and pave the way for mass adoption.

Global Adoption of Cryptocurrencies

The global adoption of cryptocurrencies has a significant impact on the crypto market size. Countries with favorable regulations and high levels of crypto awareness often experience increased adoption rates. Adoption can occur through various channels, such as merchants accepting cryptocurrencies as payment and individuals using them for remittances.

Challenges in Crypto Market Expansion

Despite its growth, the crypto market faces several challenges that affect its expansion. These challenges include:

a) Volatility: Price volatility remains a concern in the crypto market, which can discourage mainstream adoption.

b) Security Concerns: Hacks and scams in the crypto industry have raised security concerns among investors, inhibiting market growth.

c) Lack of Awareness: Many individuals are still unfamiliar with cryptocurrencies and blockchain technology, limiting their participation in the market.

Investment Opportunities in the Crypto Market

The crypto market presents various investment opportunities. These include:

a) Trading: Traders can take advantage of price volatility by buying and selling cryptocurrencies on exchanges.

b) Long-term Investment: Holding cryptocurrencies for the long term has the potential for significant returns if chosen wisely.

c) Initial Coin Offerings (ICOs): ICOs allow investors to support new projects and gain early access to potentially promising cryptocurrencies.

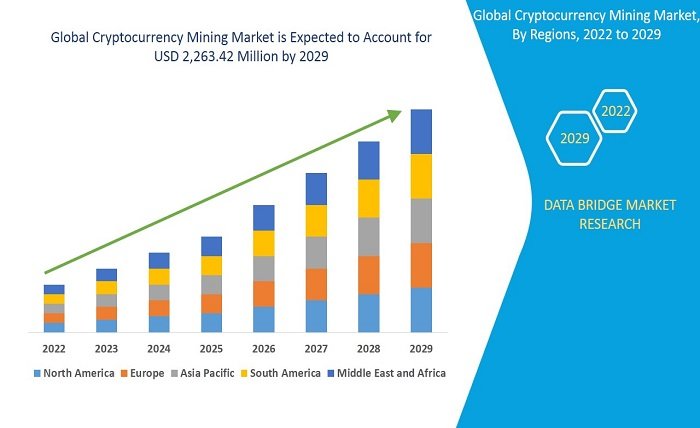

Future Predictions for Crypto Market Size

The future of the crypto market holds immense potential. Experts predict that the crypto market size will continue to expand as institutional adoption grows, regulatory frameworks mature, and technological advancements enhance scalability and usability.

Conclusion

the crypto market has grown significantly in size and importance. Factors such as technological advancements, investor sentiment, market capitalization, and government regulations influence its growth. While challenges exist, the crypto market presents numerous investment opportunities. As the industry continues to evolve, the crypto market size is expected to expand further, shaping the future of finance.