Live Crypto Prices: Tracking Real-Time Market Values

Cryptocurrencies have revolutionized the financial landscape, offering decentralized digital currencies that operate on blockchain technology. As the popularity of cryptocurrencies continues to soar, investors and enthusiasts alike seek accurate and up-to-date information on live crypto prices. In this article, we will explore the importance of tracking real-time market values, the tools available for monitoring live crypto prices, and the benefits of staying informed in the dynamic world of cryptocurrency.

Why Live Crypto Prices Matter

In the volatile world of cryptocurrencies, prices can change rapidly within minutes or even seconds. Tracking live crypto prices allows investors and traders to make informed decisions based on real-time market values. Whether you are a seasoned investor or a newcomer to the crypto space, having access to live price data is crucial for understanding market trends and maximizing potential profits.

Tools for Tracking Live Crypto Prices

Numerous platforms and applications provide live crypto price updates, catering to the diverse needs of crypto enthusiasts. Some popular tools include:

CoinMarketCap

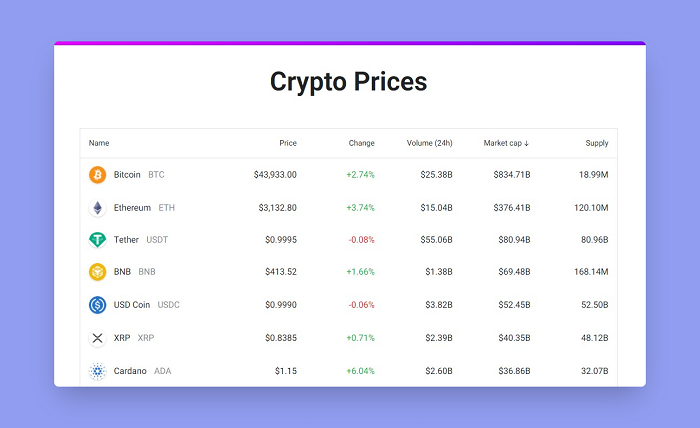

CoinMarketCap is a leading cryptocurrency data platform that offers real-time price updates, market capitalization, trading volume, and other essential metrics. It provides a comprehensive overview of the cryptocurrency market and allows users to track individual coins or create personalized portfolios.

CoinGecko

CoinGecko is another widely used platform for monitoring live crypto prices. It offers a user-friendly interface with detailed information on various cryptocurrencies, including historical data, market trends, and community engagement metrics.

TradingView

TradingView is a versatile platform that caters to both cryptocurrency and traditional market traders. It provides real-time price charts, technical analysis tools, and an active community where users can share trading ideas and strategies.

The Benefits of Staying Informed

Staying updated with live crypto prices offers several advantages in the dynamic crypto market:

Timing Opportunities

By monitoring live crypto prices, investors can identify favorable entry or exit points for their trades. Tracking price movements in real-time allows them to seize opportunities and take advantage of market fluctuations.

Risk Management

Cryptocurrencies are known for their price volatility, and tracking live prices enables investors to assess and manage risks effectively. With up-to-date information, they can set stop-loss orders, implement risk mitigation strategies, and make well-informed investment decisions.

Portfolio Management

For those managing a diversified cryptocurrency portfolio, live price tracking helps maintain a balanced allocation. By monitoring individual coin performance, investors can rebalance their portfolios based on market trends and avoid overexposure to specific assets.

How Live Crypto Prices Impact Trading Decisions

Live crypto prices have a direct impact on trading decisions, as they provide crucial information for both short-term and long-term strategies:

Day Trading

Day traders rely heavily on real-time price data to execute rapid trades and capitalize on short-term price movements. By monitoring live crypto prices, day traders can identify patterns, utilize technical analysis tools, and execute timely buy or sell orders.

Swing Trading

Swing traders aim to profit from medium-term price swings in the cryptocurrency market. They utilize live crypto prices to identify potential trends, assess market sentiment, and make informed decisions on when to enter or exit trades.

Long-Term Investing

Even long-term investors benefit from tracking live crypto prices. By staying informed about market trends, they can evaluate the performance of their investments, consider rebalancing strategies, and make well-informed decisions regarding their long-term cryptocurrency holdings.

Factors Affecting Live Crypto Prices

Several factors influence the live prices of cryptocurrencies, including:

Market Demand and Supply

The basic principles of demand and supply play a significant role in determining crypto prices. Increased demand from buyers typically drives prices up, while increased selling pressure can lead to price declines.

Regulatory Developments

Regulatory actions and announcements by governments and financial institutions can significantly impact the crypto market. Positive regulatory news often leads to price surges, while negative developments can cause market downturns.

Technological Advancements

Innovations within the crypto space, such as blockchain upgrades, protocol improvements, or the launch of new decentralized applications, can influence the value of specific cryptocurrencies. Investors closely monitor such developments to assess their potential impact on prices.

Strategies for Utilizing Live Crypto Prices

To leverage live crypto prices effectively, consider the following strategies:

Dollar-Cost Averaging

Dollar-cost averaging involves regularly investing a fixed amount of money into cryptocurrencies at predefined intervals, regardless of the current price. This strategy helps mitigate the impact of short-term market volatility and allows investors to accumulate assets gradually.

Stop-Loss Orders

Implementing stop-loss orders can protect investors from significant losses in volatile markets. These orders automatically sell a cryptocurrency when its price reaches a predetermined level, limiting potential downside risks.

Fundamental Analysis

In addition to live price data, conducting fundamental analysis can provide deeper insights into the value and potential of cryptocurrencies. Evaluate factors such as the project’s technology, team, partnerships, and community to make informed investment decisions.

Tips for Analyzing Live Crypto Prices

When analyzing live crypto prices, keep the following tips in mind:

Multiple Data Sources

Rely on multiple data sources to ensure accuracy and reliability. Cross-referencing live price data from different platforms can help verify the authenticity of information and avoid potential discrepancies.

Historical Data

Consider historical price data to identify patterns and trends. Analyzing past price movements can provide valuable insights into how cryptocurrencies behave under different market conditions.

Technical Indicators

Utilize technical indicators and chart patterns to supplement your analysis. Popular indicators like moving averages, relative strength index (RSI), and Bollinger Bands can help identify potential entry or exit points.

Risks and Challenges of Trading Based on Live Crypto Prices

While tracking live crypto prices can be advantageous, it is essential to be aware of the associated risks and challenges:

H3: Volatility

Cryptocurrencies are notorious for their price volatility, and sudden price fluctuations can result in substantial gains or losses. It is crucial to understand and manage this inherent risk when making trading decisions based on live price data.

Market Manipulation

The crypto market is susceptible to manipulation due to its relatively low liquidity compared to traditional markets. Traders should remain vigilant and exercise caution to avoid falling victim to fraudulent practices.

Emotional Decision-Making

Reacting impulsively to live price movements can lead to poor decision-making. It is important to maintain a rational mindset, stick to predetermined strategies, and avoid being swayed by short-term market fluctuations.

The Future of Live Crypto Price Tracking

As cryptocurrencies gain further mainstream adoption, the tools and platforms for tracking live crypto prices are expected to evolve. Enhanced user interfaces, real-time data analysis, and advanced charting capabilities will empower users to make more informed investment decisions.

Conclusion

Tracking live crypto prices is paramount for individuals involved in the cryptocurrency market. It provides essential insights, helps manage risks, and enables timely decision-making. By utilizing tools like CoinMarketCap, CoinGecko, and TradingView, investors can stay informed about real-time market values and seize opportunities in this dynamic industry.