Crypto Market Cap: Understanding the Key Metrics and Trends

In the ever-evolving world of cryptocurrencies, understanding key metrics and trends is essential for investors and enthusiasts alike. One of the most significant indicators in the cryptocurrency space is the market capitalization, commonly known as the crypto market cap. This article aims to provide a comprehensive overview of the crypto market cap, its importance, how it is calculated, and its relevance in evaluating cryptocurrencies. Whether you’re new to the world of digital currencies or a seasoned investor, this article will equip you with the knowledge you need to navigate the crypto market cap effectively.

Understanding Market Capitalization

Market capitalization refers to the total value of a company or asset. In the context of cryptocurrencies, it represents the total value of a cryptocurrency in the market. It is calculated by multiplying the circulating supply of a cryptocurrency by its current market price.

Importance of Crypto Market Cap

The crypto market cap serves as a key indicator of a cryptocurrency’s size and popularity within the market. It provides valuable insights into the relative standing of cryptocurrencies and their overall market dominance. By analyzing the market cap, investors can gauge the potential of a cryptocurrency and make informed investment decisions.

Calculating Crypto Market Cap

To calculate the crypto market cap of a particular cryptocurrency, multiply its circulating supply by its current market price. For example, if a cryptocurrency has a circulating supply of 10 million coins and its price is $100, the market cap would be $1 billion.

Factors Affecting Crypto Market Cap

Several factors influence the crypto market cap of a cryptocurrency. These include its popularity, adoption rate, technological advancements, regulatory developments, partnerships, and overall market sentiment. It’s crucial to consider these factors while evaluating a cryptocurrency’s market cap.

Trends in Crypto Market Cap

The crypto market cap has experienced significant fluctuations over the years. While Bitcoin has consistently maintained its position as the largest cryptocurrency by market cap, other cryptocurrencies have also witnessed substantial growth. Understanding the trends in crypto market cap can help identify emerging opportunities and potential risks.

Analyzing the Top Cryptocurrencies

The top cryptocurrencies by market cap include Bitcoin, Ethereum, Binance Coin, and many others. Analyzing their market caps, price movements, and trends can provide valuable insights into the broader crypto market and its dynamics.

Limitations of Crypto Market Cap

Although the crypto market cap is an important metric, it has certain limitations. It fails to account for factors such as the circulating supply distribution, liquidity, trading volume, and underlying technology of cryptocurrencies. Therefore, it is essential to consider other factors when evaluating the potential of a cryptocurrency.

The Role of Crypto Market Cap in Investment Decisions

Crypto market cap plays a crucial role in investment decisions. It helps investors assess the relative size and popularity of cryptocurrencies, providing insights into their potential for growth and long-term viability. However, market cap alone should not be the sole criterion for making investment decisions. Other fundamental and technical analysis tools should be considered for a comprehensive evaluation.

Influencing Factors: Market Volatility and Investor Sentiment

The crypto market cap is highly influenced by market volatility and investor sentiment. Price fluctuations, news events, regulatory decisions, and overall market conditions can impact the market cap of cryptocurrencies. Being aware of these factors can assist investors in making informed decisions and managing their risk exposure.

Read more about: r-34

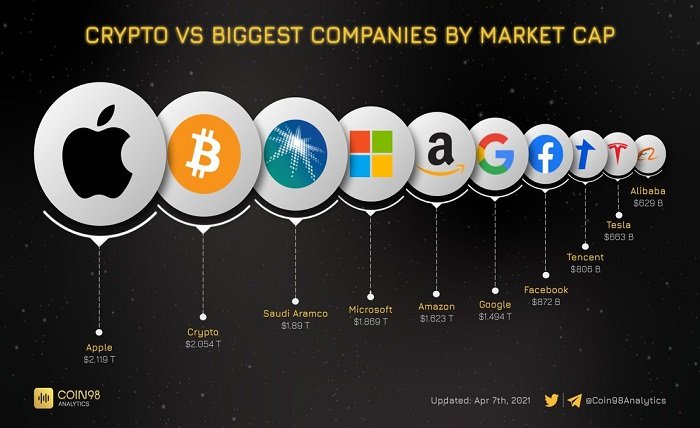

Comparing Market Cap: Bitcoin vs. Altcoins

Bitcoin, as the pioneering cryptocurrency, has consistently maintained the largest market cap. However, altcoins, or alternative cryptocurrencies, have gained traction in recent years. Comparing the market caps of Bitcoin and altcoins can provide insights into the market dynamics and the potential for diversification within the crypto space.

Market Cap and Price Correlation

While there is a correlation between a cryptocurrency’s market cap and its price, it is not a direct relationship. A cryptocurrency with a high market cap does not necessarily indicate a higher price or vice versa. Understanding this correlation is essential for investors to avoid potential misconceptions and make informed decisions.

Factors to Consider Beyond Crypto Market Cap

While crypto market cap is an important metric, it is crucial to consider other factors when evaluating cryptocurrencies. These include the team behind the project, technological innovations, real-world use cases, partnerships, competition, and community support. A holistic evaluation will provide a more comprehensive understanding of a cryptocurrency’s potential.

Future Outlook and Predictions

The crypto market cap is expected to continue its growth trajectory as cryptocurrencies gain wider acceptance and integration into various industries. However, the market remains highly volatile, and careful analysis is required to identify promising projects amidst the vast array of options available.

Risks and Challenges in Evaluating Crypto Market Cap

Evaluating crypto market cap comes with its own set of risks and challenges. These include market manipulation, lack of regulatory oversight, misinformation, and the potential for pump-and-dump schemes. Investors must exercise caution and conduct thorough research before making investment decisions based on market cap alone.

Conclusion

the crypto market cap serves as a vital metric for evaluating cryptocurrencies. It provides valuable insights into their relative size, popularity, and market dominance. While market cap is an essential factor, it should be considered alongside other fundamental and technical analysis tools for a comprehensive evaluation. Understanding the trends, factors, and limitations associated with crypto market cap will empower investors to navigate the dynamic world of cryptocurrencies more effectively.

Read more about: cloudsports24